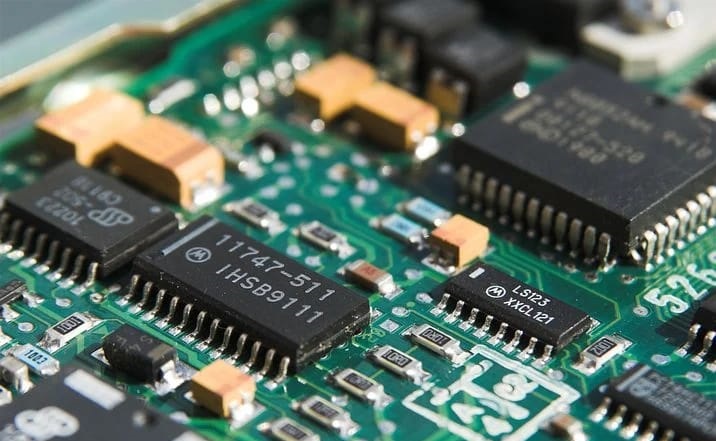

By choosing not to design, manufacture or market any semiconductor product under its own name, TSMC never directly competes with its clients, making it a preferable partner over Intel. Read More

Around the age of ten, I used to learn some form of dance and our dance school would often host group stage performances. In one dance play, Read More

As an improvement over the existing risk profiling techniques, factors such as lifetime financial experiences, past decisions and the peer group have a considerable influence on an investor’s risk profile Read More

When faced with uncertainty, we tend to assign subjective probabilities to the likelihood of an outcome. We depend on some heuristic (short-cut) to assign these probabilities. While these heuristics may generally be useful, they lead to severe and systematic errors. For instance, the distance of an object is determined by how clearly it can be seen. Read More

The field of neuroscience is the study of what happens inside the human brain when we take investment decisions and how the brain, in turn reacts to these investment decisions. Read More

We looked at the Issue closely during its launch (03 Feb 2021 – 05 Feb 2021). Brookfield’s India journey is interesting Read More

When the markets were collapsing in September 2008, Warren Buffet was accumulating GE & Goldman Sachs. He kept putting it out to people that it was the right time to buy. Read More